Redefining finance through technology

The financial sector is no longer just about capital: it’s about code. From neobanks to decentralized finance (DeFi) platforms,ll the industry is expanding at an unprecedented rate. Speed, reliability, and user experience have become the new currency.

At Lexogrine, we understand that modern fintech requires a delicate balance: robust security meets seamless performance. Technology is the catalyst driving this shift, enabling personalized wealth management, real-time trading, and automated compliance. We help established financial institutions and ambitious startups turn complex financial logic into intuitive digital products.

Solving fintech challenges with code craftsmanship

Building for finance means zero room for error. We address the industry's toughest tech hurdles using a modern, battle-tested stack.

Uncompromising security & compliance

Data breaches are not an option. We engineer solutions with "security-by-design" principles, ensuring your infrastructure meets strict regulatory standards (GDPR, PSD2) while leveraging the secure environments of AWS, Google Cloud Platform, and Azure.

Real-Time Scalability

Financial markets don't sleep. Handling high-frequency transactions requires a backend that scales instantly. We utilize Node.js and serverless cloud architectures to ensure your application performs flawlessly during market peaks without latency.

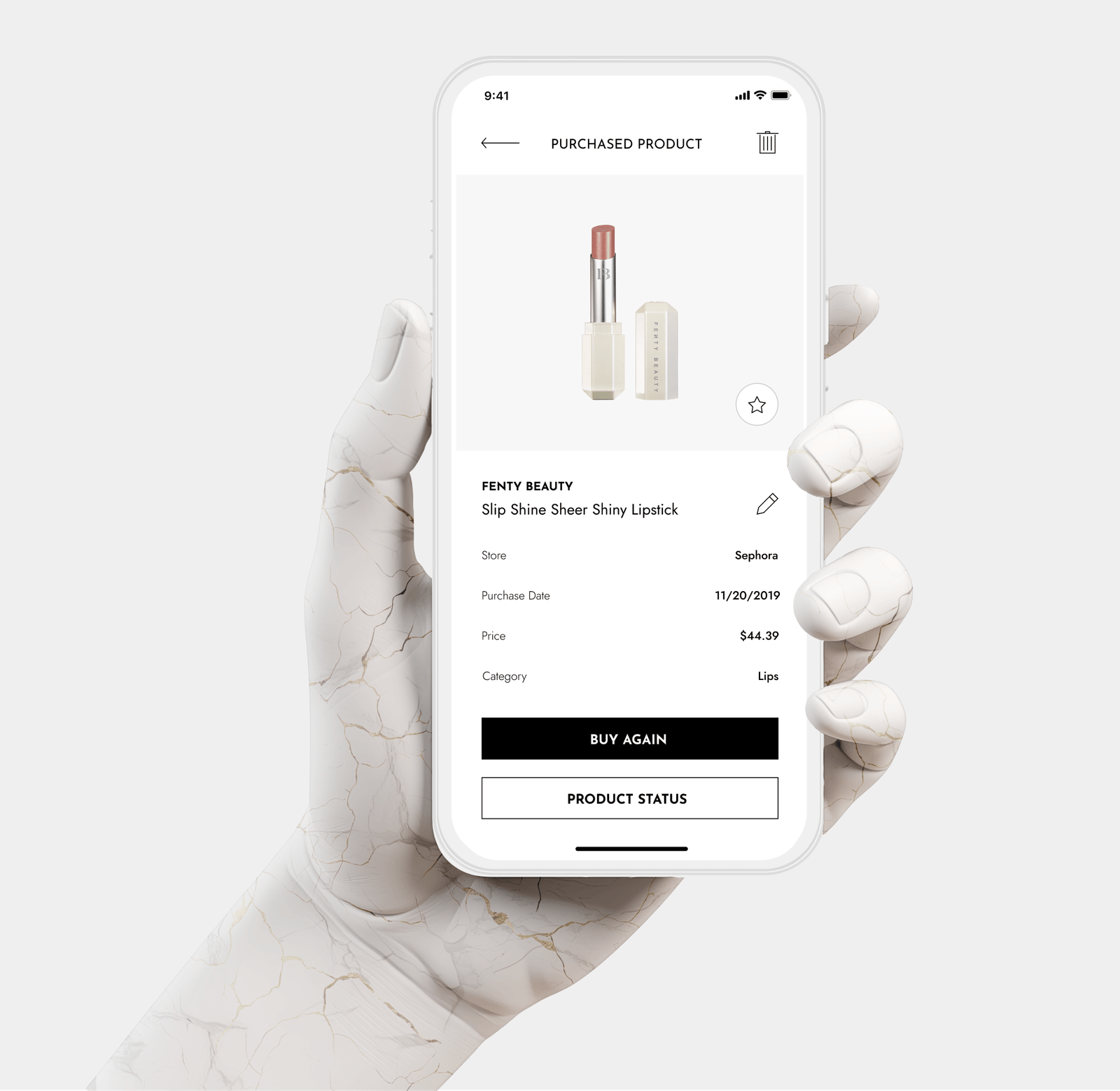

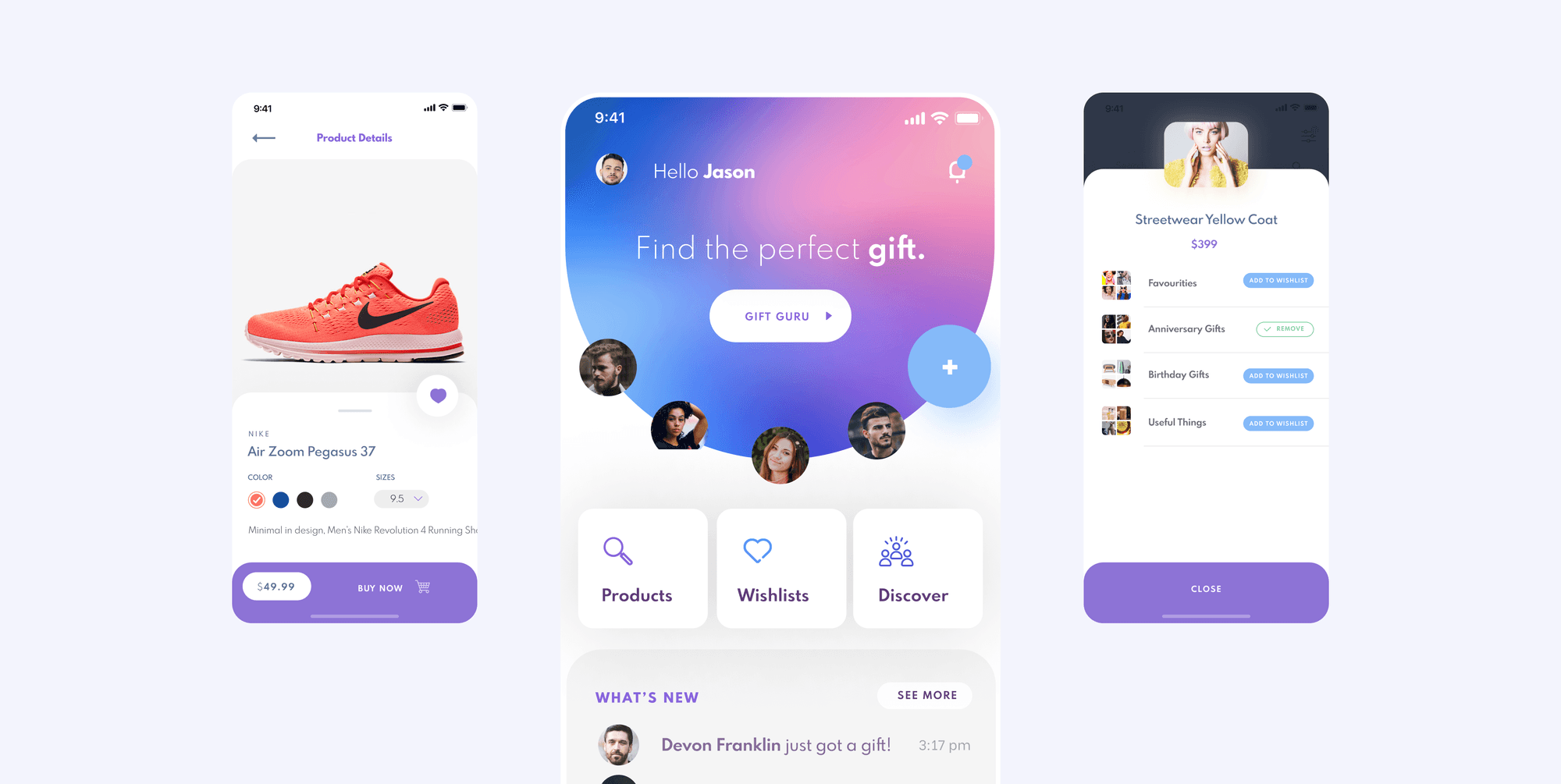

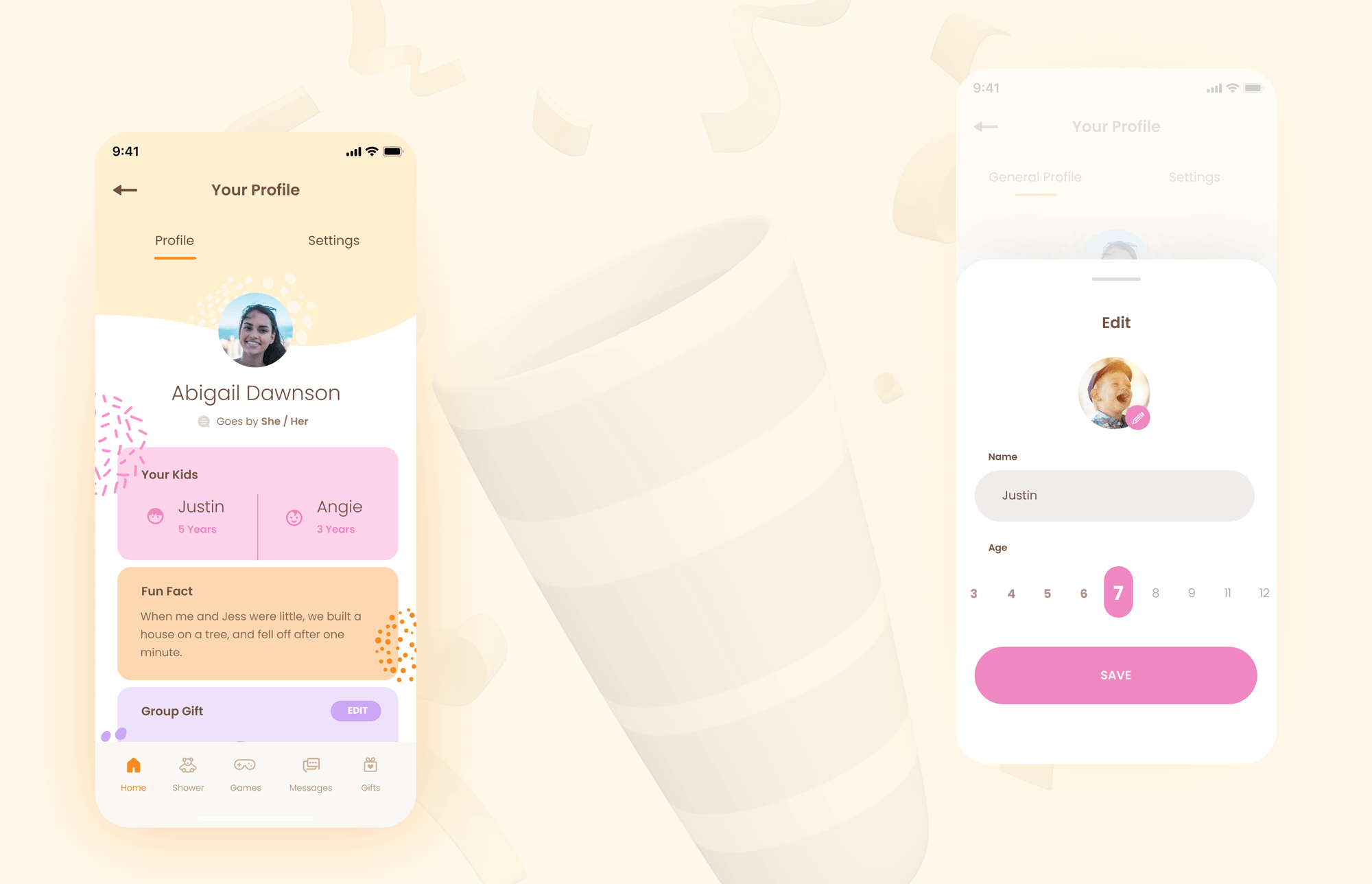

Frictionless User Experience (UX)

Trust is lost if an app lags. Users expect banking apps to be as responsive as social media. By using React and React Native, we build fluid, native-like interfaces that make managing money effortless, reducing churn and increasing user retention.

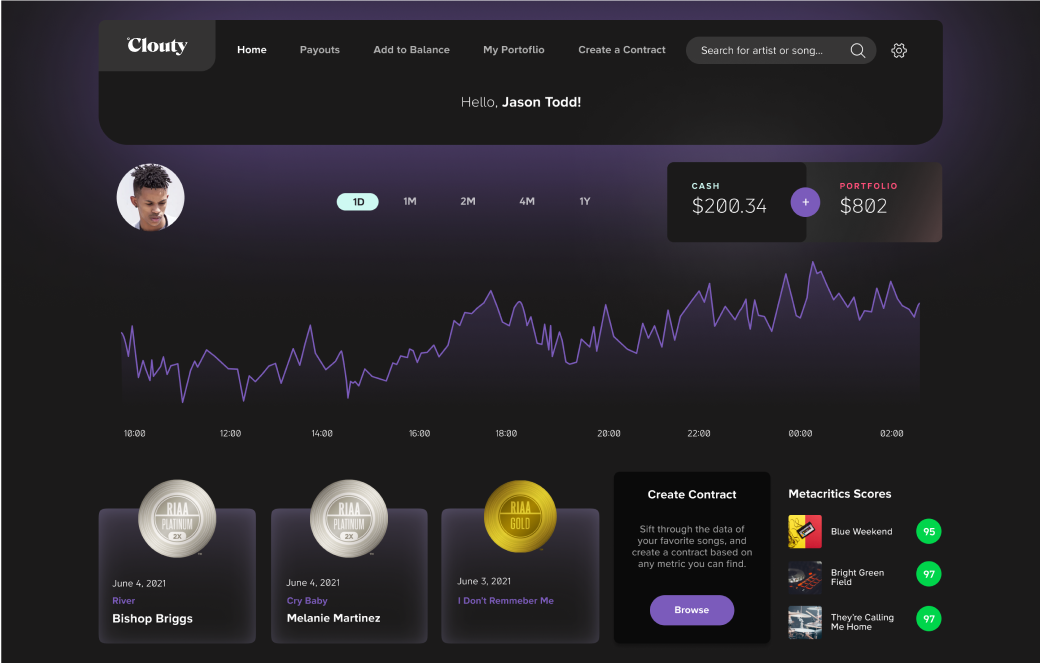

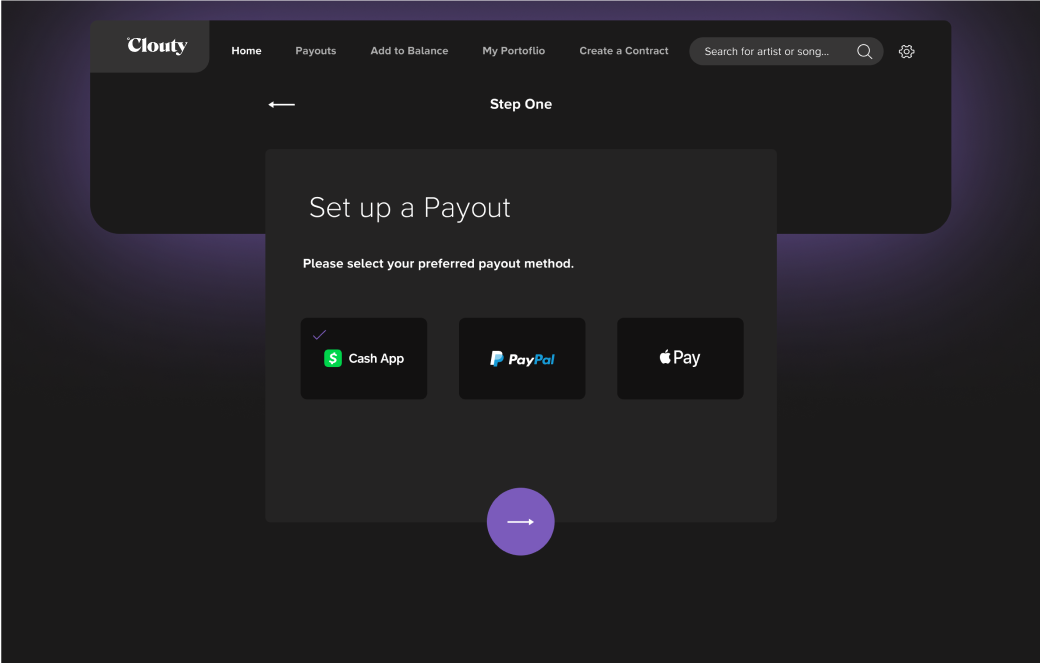

Clouty - Innovative music betting web platform

Clouty.io pioneers the concept of prediction markets for the music industry, allowing users to capitalize on their intuition by trading on song performance, artist milestones, and industry trends. The platform features a dedicated market index, bringing financial dynamics to the world of pop culture.

Although they had never heard of a project like ours, they took it upon themselves to learn more about the company.

The future of fintech: AI agents and hyper-personalization

The next decade of fintech will be defined by autonomy and intelligence. We see a shift away from static dashboards towards active financial assistants.

AI-driven personal finance

Generative AI will evolve from simple chatbots to fully autonomous agents capable of managing portfolios, executing trades based on user-defined risk profiles, and predicting cash flow gaps before they happen.

Embedded finance

Banking services will become invisible, integrated deeply into non-financial platforms (e-commerce, logistics), requiring robust API-first development.

Blockchain beyond crypto

Smart contracts will automate complex settlements and compliance checks, reducing administrative overhead to near zero.

Essential financial technology innovations

Banking and payment software solutions

Banking and payment software lie at the core of modern financial services. From mobile banking apps and digital wallets to open banking APIs and real-time transaction platforms, these technologies enable seamless, secure, and user-centric financial experiences. Efficient billing, invoicing, and payment systems are essential for speed, transparency, and compliance in the digital economy.

Wealth, trading, and personal finance platforms

Financial technology is transforming how individuals invest, trade, and manage personal wealth. AI-powered robo-advisors, mobile trading apps, and cryptocurrency management tools offer real-time insights and automation. Personal finance apps for budgeting, saving, and financial planning provide users with smarter control over their money and long-term goals.

Lending and insurance technologies

Digital lending and insurtech platforms streamline loan approvals, automate credit scoring, and personalize risk assessment. From P2P lending solutions to smart insurance claim management, these tools reduce manual work and accelerate access to financial services, enhancing efficiency and trust for both providers and users.

Why digital fintechservices matter

FAQ - Fintech Software Development

What is fintech software development?

Fintech software development refers to building digital solutions for the financial sector, including banking apps, payment gateways, robo-advisors, blockchain-based platforms, and regulatory compliance tools. These applications aim to improve customer experience, automate processes, and increase the security and scalability of financial services.

How do you ensure security in fintech applications?

Security is our top priority. We implement end-to-end encryption, secure authentication (OAuth2, Biometrics), and follow OWASP top 10 guidelines. We also conduct rigorous code reviews and testing to ensure compliance with financial regulations.

What technologies do you use for fintech software development?

We primarily use React for frontend interfaces due to its speed and component reusability, and Node.js for the backend to handle concurrent connections efficiently. For mobile apps, we rely on React Native. Our infrastructure is built on secure Cloud providers like AWS to ensure scalability and compliance.

How can AI improve fintech applications?

AI in fintech is used for smart customer service (via chatbots), algorithmic trading, predictive analytics, personalized financial advice, and real-time fraud detection. Implementing AI helps financial institutions automate tasks, lower costs, and make data-driven decisions faster.

Can you integrate AI into my existing financial software?

Yes. As an AI-first company, Lexogrine specializes in integrating LLMs and AI agents into existing workflows. We can help you add features like automated customer support, fraud detection, or predictive analytics to your current platform.

Do you support legacy banking system migration?

Absolutely. We specialize in digital transformation, helping financial institutions migrate from monolithic legacy systems to modern, microservices-based cloud architectures that are easier to maintain and scale.

Why choose Lexogrine as a fintech software development company?

We combine deep technical expertise in technologies like React, Node.js, React Native, and AI with a business-oriented approach. We deliver Code Craftsmanship: solutions that are robust, scalable, and designed to give you a competitive edge in the financial market.

How much does it cost to develop a fintech application?

The cost of developing a fintech application depends on multiple factors, such as the type of product (e.g., digital wallet, investment platform, or lending app), feature complexity, integrations, compliance requirements, and security standards.

Fintech software development often involves working with sensitive data and regulated environments, which adds layers of complexity. The best way to estimate the cost is to consult with an experienced fintech development partner who can assess your needs and propose a tailored solution. Lexogrine offers dedicated Product Discovery and Workshops to analyze your needs and requirements in detail.

Why choose Lexogrine as your fintech app development company?

Lexogrine delivers secure, scalable, and compliant fintech software solutions, including payment gateways, fraud detection, regulatory compliance, and AI-powered financial analytics.

Our fast, reliable development helped fintech startup Clouty raise a $1.5M Seed Round, proving the impact of the right tech partner.

Voices of trust and satisfaction

5.0

The Lexogrine team has great chemistry, and I’d advise clients to hire them and let them work internally on the project. I haven’t seen the synergy they have anywhere else — they were able to work out different aspects of the project between themselves.

Work with them because they're good. If you can find them and they have the bandwidth, they'll do a better job than anybody else on your radar.

Willingness to be available 24/7. They never complain about work scope or new problems that we faced after the initial deal.